CDs ( Einlagenzertifikate ) werden von Banken an Anleger ausgegeben. Der Investor leiht dem Institut Geld für einen festgelegten Zeitraum und erhält dafür einen festgelegten Zinssatz. Geldmarktkonten – auch Geldmarkteinlagenkonten oder MMDAs genannt – ähneln eher Girokonten, da Geld hinzugefügt werden kann, der Zinssatz variabel ist und Abhebungen (mit Einschränkungen) jederzeit vorgenommen werden können.

Contents

Vergleichstabelle

| Einzahlungsschein | Money Market Account | |

|---|---|---|

| Introduction | A certificate of deposit is a time deposit, a financial product commonly offered to consumers in the United States by banks, thrift institutions, and credit unions. | A money market account or money market deposit account (MMDA) is a financial account that pays interest based on current interest rates in the money markets. |

| FDIC insured | Yes (up to $250,000) | Yes (up to $250,000); money market funds are not FDIC insured but deposit accounts are. |

| Average one-year return (U.S.) | 0.44% | 0.04% |

| Withdrawal Restrictions | Penalty for early withdrawals. Partial withdrawals not allowed; the entire balance must be withdrawn in one go. | 3-6 withdrawals per month. |

| Withdrawals | Only after maturity | Any time |

| Minimum Balance | Sometimes; varies by bank | $1000 or more |

| Additional deposits | Not permitted; the principal amount for a CD is fixed at the beginning | Any time |

| Checks | No | Yes (for some accounts) |

| ATM card | No | Yes (for some accounts) |

| Interest Rate | 0.1% – 2% depending upon the term duration of the CD. | 1% – 4%. |

| Access to funds | None without terminating the instrument | Immediate |

How they work

How CDs work

With a certificate of deposit (CD), investors choose a fixed amount (called denomination of the CD) to invest for a fixed duration (the term ). There is generally a $500 minimum. At the end of the investment period, the CD matures and the investors get their principal and interest back. Investors are not allowed to add any money to an existing CD; they must invest in a new CD if they want to invest more money.

How money market accounts work

A money market account is similar to a checking or savings account in that it is an “active” account where money can be invested — more money can be added and money may even be withdrawn. Money market accounts are therefore more liquid compared with CDs. The downside to this is that money market accounts generally offer lower interest rates. Money market accounts also have higher minimum balance requirements than traditional savings accounts .

<iframe width=”450″ height=”253″ frameborder=”0″ allowfullscreen src=”https://www.youtube.com/embed/Gpc8IReGy2Y?iv_load_policy=3&rel=0″></iframe>

Interest Rates

While money market account rates change as rates fluctuate, CDs offer a fixed interest rate for the term. CDs with higher denominations generally yield a higher annual percentage (APY) . Similarly, CDs with longer maturity periods tend to offer higher interest rates. Smaller institutions and credit unions sometimes offer better interest rates, as do online-only financial institutions.

<iframe width=”450″ height=”338″ frameborder=”0″ allowfullscreen src=”https://www.youtube.com/embed/KOulleKuXfU?iv_load_policy=3&rel=0&start=80″></iframe>

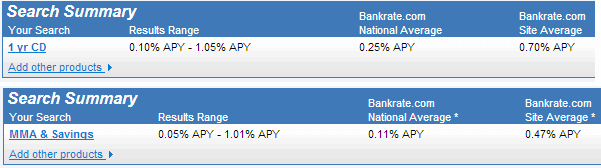

As of May 2013, the average 1-year return from a money market account is 0.04%, while the average return on a CD is 0.44% according to BankRate.com .

A comparison of national average interest rates for CDs and Money Market accounts as of May 3, 3013 according to BankRate.com

Withdrawal Restrictions and Liquidity

Funds deposited in a CD can only be withdrawn after maturity. This can range from a few weeks to several years, depending on the type of CD.

Funds deposited in a money market account can be withdrawn almost at will, but there are usually some limits to the number of withdrawals made in one month.

Contribution Limits

CDs do not allow individuals to add more money over time.

Additional funds can be added to money market accounts, as with a checking of savings accounts.

Other Services

Some banks offer checks and ATM cards with money market accounts. No such services are available with a CD.

Money market accounts vs savings accounts

Money market accounts are rather similar to savings accounts — both are active accounts that allow money to stay liquid. Traditionally, a money market account would pay a higher interest rate in exchange for a higher minimum balance and fewer withdrawals allowed every month compared with a savings account. However, with online banking, the interest rate is quite comparable to that of MMAs. A money market account also allows easier access to the funds as compared to a savings account.

Money market accounts make more sense for saving a large amount of funds on a shorter term, especially if you’d like to write a check directly from that account. Traditional savings account make more sense for long-term saving over the course of years, especially if the initial deposit amount is low, or if it is difficult to maintain the minimum balance.

For a more detailed comparison see Savings vs Money Market Accounts .

Money market accounts vs Money market funds

Money market accounts (or deposit accounts) should not be confused with money market funds (or money market mutual funds – MMMFs). Money market funds are mutual fund investments and are not FDIC insured. Like any mutual fund, the fund manager charges a fee for administrative, sales and other expenses associated with managing the fund. This fee lowers the return offered by the fund. There is no guaranteed return in a money market fund while a money market deposit account offers a specific interest rate. The rate may vary with the market but it is always known.

References

- wikipedia:Money market account

- wikipedia:Certificate of deposit