Capital One Quicksilver and Chase Freedom credit cards offer attractive cash back rewards. Chase Freedom offers an unlimited 1% cash back on all purchases and 5% cash back on up to $1,500 spent on “bonus” categories that change every quarter (e.g., spending on gas or on Amazon). Capital One’s Quicksilver card does not bother with purchase categories and instead offers an unlimited, flat 1.5% cash back on all purchases. Neither card charges an annual fee for use but the Capital One Quicksilver card has no foreign transaction fees either. Chase Freedom levies a 3% fee on foreign transactions. For balance transfers, the Chase Freedom card offers a longer 0% APR period.

Contents

Comparison chart

| Capital One Quicksilver | Chase Freedom | |

|---|---|---|

| Annual Fee | None | None |

| APR | 0% intro APR for a year. 12.9% to 22.9% variable APR after that. | 0% intro APR for the first 15 months after account opening. 13.99% to 22.99% variable APR after that. |

| Cash Back | Unlimited 1.5% back on all purchases. | 5% back (on up to $1,500 in purchases, i.e., $75 cash back) on certain stores or categories of purchases that change every quarter. Unlimited 1% back on all purchases outside of bonus categories and beyond $1,500 bonus limit. |

| Minimum Amount to Redeem Rewards | None, can redeem at any time | $20 |

| Special Offers | One-time $100 bonus after spending $500 on purchases within the first 3 months | One-time $200 bonus after spending $500 within 3 months of opening the account. |

| Balance Transfer | Yes, with 3% charge. Offers 0% APR on the transferred balance for the first 12 months. | Yes, with 3% charge. Offers 0% APR on the transferred balance for the first 15 months. |

| Cash Advance Fee | $10 or 3% fee, whichever is greater. Variable APR of up to 24.9% on cash advances. | $10 or 3% fee, whichever is greater. Variable APR of 19.24% to 23.24% on cash advances. |

| Foreign Transaction Fee | None | 3% of each transaction in U.S. dollars. |

| Over the Limit Fee | Up to $35 | Up to $35 |

| Late Fee | Up to $35 | Up to $15 for evey $100 spent, $25 for every $100 spent, $35 for every $250. |

| Grace Period | 25 days | 21 days |

| Payment System Type | Visa | Visa |

Rewards

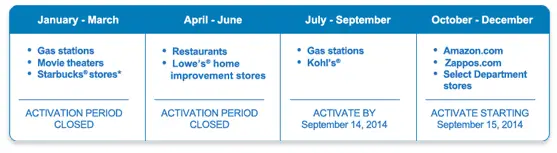

Chase Freedom offers an unlimited 1% cash back on all purchases and 5% cash back on purchases made in certain “bonus” categories which change every three months and tend to include gas stations, restaurants, department stores, online stores, and movie theaters on a rotating basis. The 5% cash back rate only applies to the first $1,500 spent on these purchases in each quarter. The screenshot below lists Chase Freedom’s bonus categories for 2014 (note that “activation” is required every three months, which means the consumer is required to take this action; the cash back rewards are not automatically assigned):

Chase Freedom bonus categories for 2014 that yield 5% cash back on purchases.

The Capital One Quicksilver does not have rotating categories but instead offers 1.5% cash back on all purchases with no limit to the amount of cash back earned. This is a better deal for some consumers who either do not want the hassle of keeping track of and enrolling in “bonus” categories or spend more money overall, so an extra 0.5% cash back on all purchases is worth more than $75 (which is the limit for the 5% cash back in a quarter from Chase Freedom).

Reward Redemption

Capital One’s Quicksilver and Chase’s Freedom offer similar ways to redeem rewards. Both offer statement credit, gift cards, checks, charitable donations, and other similar options as means of redemption.

Minimum Amount for Redemption

One advantage the Capital One Quicksilver has over the Chase Freedom is that Capital One does not impose a minimum amount to redeem cash back; cash back can be redeemed any time. Chase Freedom requires a minimum of $20 (2,000 points) to redeem cash back.

Signing Up for Capital One Quicksilver or Chase Freedom

Neither the Capital One Quicksilver nor the Chase Freedom has an annual fee, but consumers need a relatively good credit score to be approved for either card. Generally, Chase is a little more forgiving than Capital One. On average, approved Chase Freedom card users have a credit score of 682 compared to the approved Quicksilver card user’s average credit score of 709. [1] [2]

Annual Percentage Rate (APR)

Both cards offer an introductory APR of 0%. Lasting for 15 months, Chase Freedom’s introductory period is longer than Capital One Quicksilver’s 12-month deal.

To avoid being charged interest, credit card owners should pay off their card balances during each billing period. However, if a balance is kept on a card, both cards are likely to offer similar interest rates. Capital One’s Quicksilver card gives owners interest rates between 12.99% and 22.99%, while owners of the Chase Freedom card are given interest rates between 13.99% and 22.99%.

Penalty APR

When a card owner’s account is delinquent for 60 days or more, both card companies will apply a “penalty APR” to whatever balance is on the card. The penalty APR on these cards is nearly identical. The Chase Freedom’s penalty APR is 29.99% compared to the Capital One Quicksilver’s 29.4%.

Balance Transfers

The Capital One Quicksilver and Chase Freedom cards apply the same 3% charge on all transferred balances. For example, if a card owner transfers $1,000 onto either card, an additional $30 will be added to the newly transferred balance for the cost of the service.

With both cards sporting similar APRs — these cards’ balance transfer APRs fall within the same range as their regular APRs — it might seem as though there is no clear winner between the two. However, the Chase Freedom offers a 15-month 0% APR on transferred balances compared to the Capital One Quicksilver’s 12-month 0% APR period.

In addition to this more forgiving APR period, Chase is more likely to take on larger balances, as it tends to give card owners much higher credit limits than Capital One does. So if transferring a large amount — $1,000 or more — is a concern, the Chase Freedom card is the better choice.

Cash Advance

On both cards, a 3% fee — or $10, whichever is greater — is charged for cash advances. Each card applies a variable APR on cash advances, with the Chase Freedom’s — 19.24% to 23.24% — slightly more forgiving than the Capital One Quicksilver’s — 24.9%.

Using the Capital One Quicksilver and Chase Freedom Overseas

For frequent travelers, the Capital One Quicksilver is the clear winner when it comes to these two cards. While the Chase Freedom card charges a 3% foreign transaction fee on all purchases made in a different currency in another country, the Capital One Quicksilver completely waives this common fee.

Other Perks

The Chase Freedom and the Capital One Quicksilver are both Visa Signature cards, which means they offer extra perks , like extended warranty protection on purchases, rental car collision damage waiver, 24-hour emergency assistance, roadside assistance dispatch, and travel accident insurance.

References

- Capital One Quicksilver (official site)

- Chase Freedom (official site)

- Compare Credit Cards at WasIstDerUnterschied

- Benefits of Visa Signature cards